Marketing fintech companies in Kenya requires specialized expertise that most general digital marketing agencies simply don’t have. While comprehensive digital marketing agencies in Kenya offer broad services, the fintech marketing agencies in Kenya listed below understand regulatory compliance, trust-building for financial services, and how to acquire customers in a market where 102 fintech companies compete for attention.

Kenya’s fintech sector accounted for a smaller share of equity funding in 2024 compared to previous years, even as the country secured $638 million in startup funding overall. This shift means fintech companies need smarter marketing strategies to stand out, attract investors, and convert skeptical users into loyal customers.

The agencies below specialize in financial technology marketing, from mobile lending platforms to payment solutions, digital wallets, and investment apps.

1. Nairobi Marketing – Best for Fintech Growth Marketing

Location: Nairobi, Kenya

Specialization: Fintech SEO, PPC for Financial Services, Compliance-Ready Marketing

Nairobi Marketing understands fintech marketing challenges that generic agencies miss: regulatory compliance messaging, building trust with first-time digital banking users, and navigating Kenya’s Data Protection Act requirements.

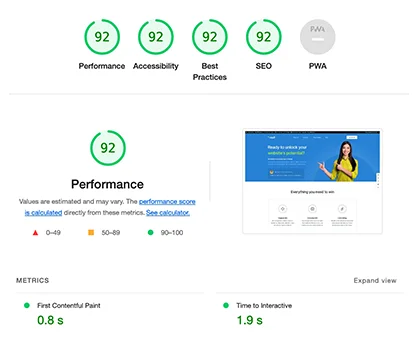

Their SEO approach for fintech focuses on ranking for high-intent keywords like “best mobile loan app Kenya,” “digital wallet without charges,” and “how to invest money Kenya.” They don’t chase vanity traffic. They target searches that indicate readiness to download, register, or invest.

The PPC strategy emphasizes compliance-approved messaging. Financial services ads face strict review processes on Google and Meta platforms. Nairobi Marketing writes ad copy that passes review while still converting, focusing on value propositions like “instant approval” or “no collateral required” without triggering compliance flags.

For fintech companies needing comprehensive customer acquisition, their growth marketing approach combines paid acquisition, conversion optimization, email nurturing, and retention campaigns. They track metrics that matter: cost per install, activation rate, loan application completion rate, and customer lifetime value.

What makes them effective for fintech is their understanding of the entire user journey. Getting app downloads means nothing if users don’t complete KYC verification. They optimize every step from first click to active user, identifying where friction occurs and fixing it.

Month-to-month contracts after an initial quarter mean fintech startups aren’t locked into long commitments during uncertain funding environments. Clients own all content and assets, which matters when pivoting strategies or bringing marketing in-house after Series A.

For fintech companies prioritizing customer acquisition costs, compliance, and measurable growth metrics, Nairobi Marketing delivers performance marketing without the agency fluff.

2. TopOnlineConsultants

Location: Nairobi, Kenya

TopOnlineConsultants positions itself as a performance-focused agency with fintech expertise. Their multi-industry experience includes financial services, and they emphasize ROI-driven campaigns across Google, Meta, X, and TikTok.

They offer custom strategies per platform, which matters for fintech marketing where LinkedIn might work for B2B payment solutions while TikTok reaches younger borrowers for consumer credit apps. Their analytics-heavy approach helps fintech companies understand which channels drive actual conversions, not just awareness.

3. CorporateWebPro Agency

Location: Nairobi, Kenya

CorporateWebPro Agency specializes in financial services marketing, including fintech and insurance. Their experience with regulated industries means they understand compliance requirements for financial advertising in Kenya.

They focus on high-value lead generation rather than volume, which suits fintech companies where a qualified loan applicant or investment client is worth significantly more than a casual app download. Their PPC campaigns target serious buyers searching for specific financial solutions.

4. E29 Marketing

Location: Kenya (serving regional clients)

E29 Marketing’s strength lies in brand strategy and positioning, valuable for fintech companies needing to differentiate in crowded markets. When multiple apps offer similar services, brand perception determines which one users trust.

Their influencer campaign experience helps fintech companies leverage trusted voices in Kenya’s financial education space. Reviews consistently praise their strategic insight and ability to reduce customer acquisition costs through better targeting.

5. KWETU Marketing Agency

Location: Nairobi, Kenya

With 11+ years of experience, KWETU combines digital marketing with on-ground activations. For fintech companies launching new products, their experiential marketing creates touchpoints where potential users can interact with platforms in controlled environments.

Their influencer marketing connects fintech brands with financial literacy influencers and tech reviewers who shape opinion among young Kenyans. Their integrated approach blends social media, events, and digital campaigns for comprehensive market penetration.

What Fintech Companies Need in Marketing Agencies

The right fintech marketing agency understands financial services regulations, trust-building for digital-first products, and customer acquisition economics specific to financial technology.

Regulatory Knowledge: Agencies must navigate Central Bank of Kenya guidelines, Data Protection Act requirements, and advertising standards for financial services. Marketing that ignores compliance creates legal exposure.

Trust Building: Fintech marketing requires addressing user skepticism explicitly. Agencies should understand how to communicate security features, licensing, and customer protection without sounding defensive.

Customer Acquisition Economics: Fintech unit economics demand precise tracking. Agencies must measure cost per install, activation rate, first transaction rate, and customer lifetime value, not just impressions or clicks.

Mobile-First Execution: With 70% of web traffic occurring via mobile devices in Kenya, fintech marketing must prioritize mobile user experience, app store optimization, and mobile ad formats.

Industry-Specific Challenges: Different fintech verticals face unique challenges. Mobile lending needs to address debt stigma, digital wallets must explain security, investment platforms require investor education, and payment processors need merchant acquisition strategies.

For fintech companies operating in adjacent industries, specialized marketing expertise matters. Payment processors benefit from understanding e-commerce marketing strategies, while property financing platforms need insights from real estate marketing specialists. Companies targeting high-net-worth individuals might learn from hotel marketing approaches to luxury service positioning.

Kenya’s fintech marketing landscape requires agencies that understand both digital performance and financial services nuances. The agencies listed offer varying strengths from compliance-ready campaigns to brand building and customer acquisition.

Choose based on your specific needs: early-stage user acquisition, Series A growth scaling, brand differentiation, or compliance-first campaigns. Ask agencies about their experience with financial services regulations, customer acquisition costs they’ve achieved for similar products, and how they measure success beyond vanity metrics.

The right agency partnership drives sustainable growth through marketing that converts skeptical users into active, loyal customers.